Car Insurance Act in Thailand: What Are the Differences Between Each Type and How Much Do They Cost?

(Photo credit: Old Tree)

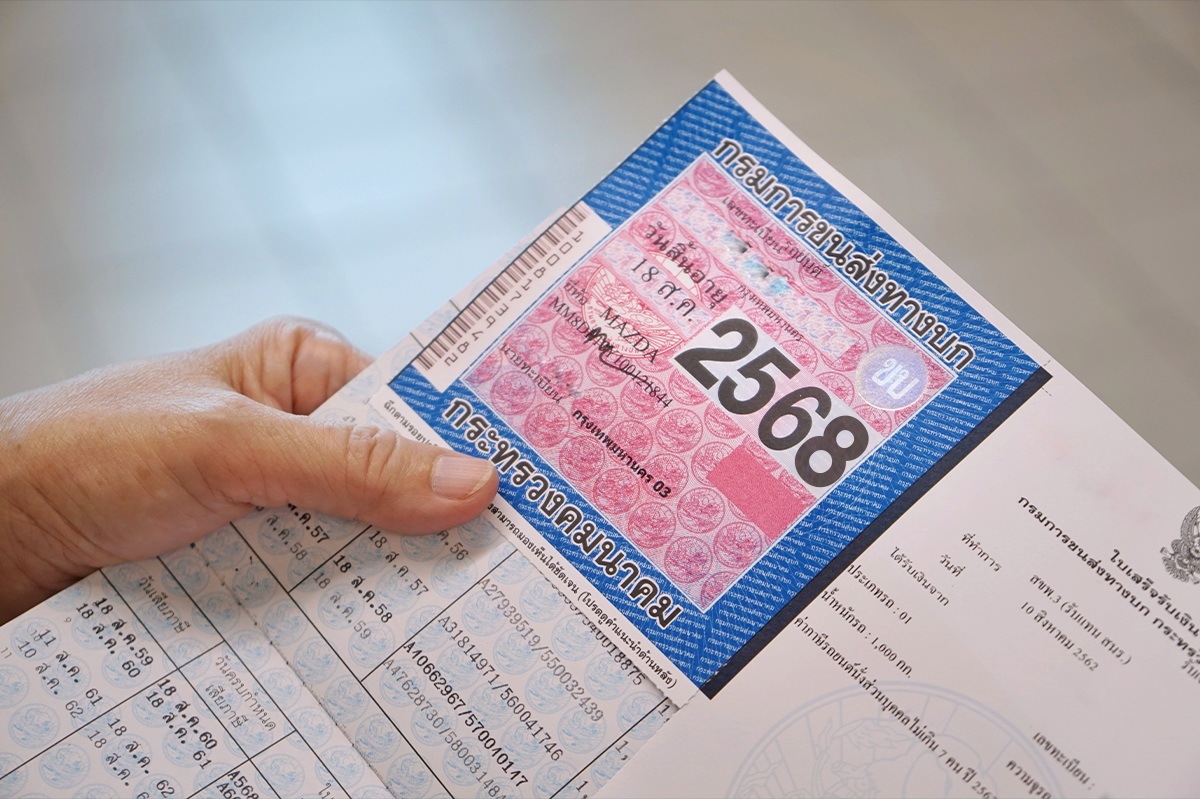

If you’re a car or motorcycle owner in Thailand (or planning to become one), understanding the Compulsory Motor Insurance (known locally as Por Ror Bor) is essential.

It’s not only required by law but also provides crucial basic coverage in case of road accidents. But did you know that the cost and coverage vary depending on your vehicle type? This article breaks it down clearly and accurately to help you stay informed and compliant.

What Is Por Ror Bor (Compulsory Motor Insurance)?

Por Ror Bor stands for the Motor Vehicle Accident Victims Protection Act B.E. 2535. It’s mandatory insurance for all vehicles registered in Thailand. Driving without valid Por Ror Bor can result in a fine of up to 10,000 THB. Even if you have it, failing to display proof in your vehicle could get you fined again.

The main benefit of Por Ror Bor is that it provides essential coverage in the event of injury or death due to a road accident. This applies to drivers, passengers, and even pedestrians.

Updated Prices of Por Ror Bor by Vehicle Type

The cost of Por Ror Bor varies based on your vehicle type and engine size:

1. Motorcycle Insurance

- Under 75cc: From 150–200 THB

- 75–125cc: From 300 THB

2. Personal Car Insurance

- Private cars with up to 7 seats: From 600 THB

- Passenger cars with over 7 seats: From 1,000 THB

3. Truck Insurance

- Trucks over 3 tons but not more than 6 tons: From 1,200 THB

- Vehicles carrying flammable or hazardous materials under 12 tons: From 1,600 THB

- Trucks over 12 tons: From 2,300 THB

The difference in prices reflects varying risk levels — larger vehicles or those transporting hazardous materials typically require higher premiums due to greater accident impact potential.

Final Thoughts

Regardless of the type of vehicle you own, renewing your Por Ror Bor on time is essential. It’s not just about staying within legal boundaries — it’s about ensuring that you and those around you are protected when accidents happen.

If you need help navigating car-related decisions like comparing loans, refinancing options, or title loans, Motorist Thailand is here to help. We provide free, impartial advice and partner with leading banks nationwide to help you find the best financial option that suits your needs.

Claim your free car valuation today!

Read More: Title Loan vs. Car Refinance: What’s the Difference and Which One Is Right for You?

Looking for a car appraisal? You can contact us for a free car valuation within 24 hours…